Bitcoin Move Proves Craig Wright is a Liar

The bitcoin wallet address, 17XiVVooLcdCUCMf9s4t4jTExacxwFS5uh, was rewarded a 50 coin block reward in 2009 and for the past 11 years has remained dormant until yesterday when 10 coins were sent through an apparent mixer, while the remaining 40 coins ended up in change wallet.

The movement was quickly determined to be unlikely Satoshi Nakamoto's, although without Satoshi himself or the owner of wallet 17XiVVooLcdCUCMf9s4t4jTExacxwFS5uh to confirm, this cannot be proven either way.

Calling Dr. Wright

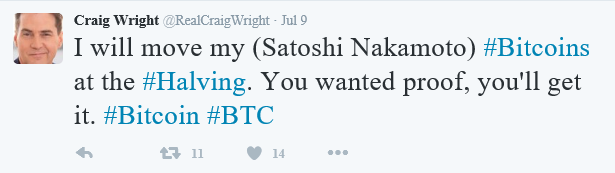

In 2016, Dr. Craig Wright made the claim that he was Satoshi Nakamoto, but has not been able to provide any proof to back it up.

The claim was quickly refuted by the community who demanded Wright prove his identity by simply executing small transaction from one of the known Satoshi wallets. As expected by many, Wright was, and has been, unable to accomplish this or provide a realistic reason as to why he cannot.

Wright has been active in the industry to the point of landing himself in legal trouble both in Australia and in the United States where he was sued by Ira Kleinman, as personal representative of the estate of David Kleinman, and W&K INFO DEFENSE RESEARCH, LLC in 2018.

The briefly outline that case, David Kleinman was an associate of Wrights who died in 2013, his estate claims that he and Wright mined Bitcoin together as a company under which Kleinman is entitled to 50% of the holdings, a claim that Wright denied stating the Kleinman transferred his share to Wright in exchange for interest holding in a now failed company.

As part of discovery Kleinman's estate request all Bitcoin related documents from Wright to which he objected and eventually the Judge required Wright to produce only a specific amount of data within a more realistically relevant period of time, one of which was a list of bitcoin wallets owned between the periods of 2009 and 2013.

Wright ultimately delivered this list but testified that whereas he is the true owner of these wallet addresses, all of which fall within the period of time plausible to support Satoshi Nakamoto ownership, however, he could not deliver the private keys stating that nobody has access to them.

Rather, Wright testified that the private keys were split into key slices under the Shamir scheme, that nobody had full access to since each member of a trust formed in 2011 as Tulip Trust, has a portion of the private keys and as such, all members are required to provide their key slice per public wallet address to access the wallet.

Ultimately, Judge Bruce Reinhart admitted there lacked conclusive proof of any intentional falsification of evidence by Wright, however, noted the lack of motive for intentional falsification of evidence by anyone other than Wright and felt that Wright's behavior was inconsistent with common sense.

In other words, the Judge didn't believe him.

The Wright List

Wright submitted a list of public bitcoin addresses he testified to have mined between 2009 and 2010 directly to Tulip Trust. On that list is none other than wallet address: 17XiVVooLcdCUCMf9s4t4jTExacxwFS5uh on line 3654.

The full list (PDF) submitted by Wright ca be located here: gov.uscourts.flsd.521536.266.1.pdf

Craig Wright Lies

When 50 bitcoin moved from the wallet in question yesterday, Wright's lies were also exposed.

According to Wright, he cannot access any of the bitcoin held in any wallet address listed on the court submission due to lacking a key slice forever lost with Kleinman when he passed away in 2014.

Which would mean, nobody else can either.

This is because all key slices are required to combine into a private key for access. However, as is evident with yesterday's transaction, somebody has the private key.

This means of of two things:

- Craig Wright has access to this wallet and will have finally shown an ability to tell the truth; or,

- Craig Wright is full of shit, lied to the court (again), and stole a dead man's bitcoin.

The former would be one of many steps to destroy us all as tweeted by Wright some time ago when he threatened to move all of his bitcoin and crash the market.

Notably, this time has come and gone and as expected by most, nothing moved anywhere and nobody did anything. At least not until the small transaction yesterday which we'll likely discover had nothing to do with Wright.

However, what it will do is cause Wright some more legal troubles, potentially accompanied with another contempt of court.

[accordion] [item title="Author and Credits"] Article by dinbits

Image Credits: Banner Image by dinbits.com staff

Image Credits: Banner Image by dinbits.com staff

[/item] [item title="Disclaimer"]The opinions expressed by authors of articles linked, referenced, or published on dinbits.com do not necessarily express, nor are endorsed by, the opinions the of dinbits.com or its affiliates. Please review the Terms of Use for more information.[/item] [/accordion]